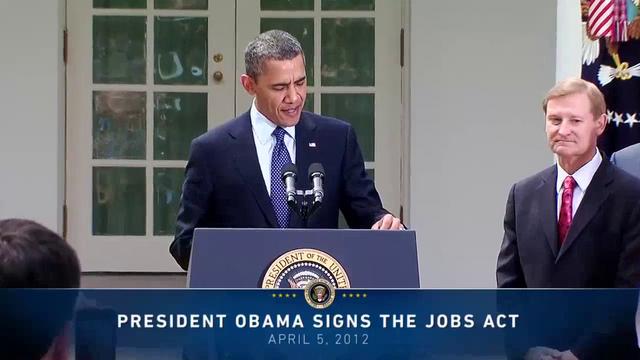

24 Jun SEC: One Year Since Certain JOBS Act Rules Were Due

A new SEC Chair has been in place for several months and her key top advisors are also now ensconced. She acknowledges the obligation of the Commission to attend to a variety of statutorily mandated rulemakings under both the Dodd-Frank Act and the Jumpstart our Business Startups (JOBS) Act. On our radar here from JOBS: crowdfunding, Regulation A, and ending the ban on general solicitation in Regulation D offerings. A few sentences on each.

JOBS required the SEC to pass an admittedly complex set of rules to allow small businesses to raise up to $1 million more easily from large groups of people than is currently permitted through crowdfunding. There is tremendous populist appeal for this and the rules were required to be finalized last December, 2012. Regulation A, a somewhat easier way to do an IPO, also was going to be more accessible and attractive. There is no deadline on those rules, but we know the staff is working on them and Congress is contemplating passing a bill to impose a deadline. For offerings to be clearly non-public, the SEC passed Regulation D back in 1982 as a safe harbor. One condition then: no advertising or general solicitation for investors. JOBS said that ban should end as long as all investors are “accredited” (income at least $200,000 or net worth $1 million not counting your primary residence). It told the SEC to write the rules to implement this no later than July 5, 2012.

The SEC almost passed “final interim temporary” rules on general solicitation which could have taken immediate effect, but at the last minute changed it to a customary proposed rule on the subject in late August 2012. Since then there has been no further action except an intervening Presidential election and change in SEC leadership. As we approach our Nation’s anniversary on July 4 we also approach the one year anniversary since the rules were required to be finalized. I hope Ms. White and her team focus their summer writing on these very important JOBS Act rulemakings.

No Comments