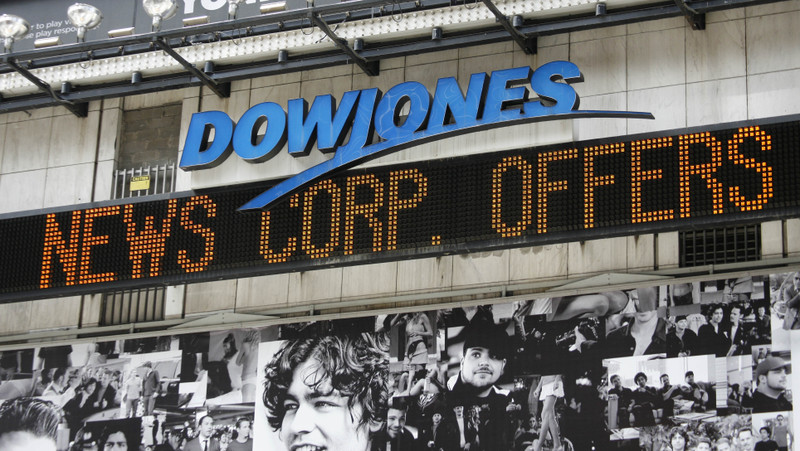

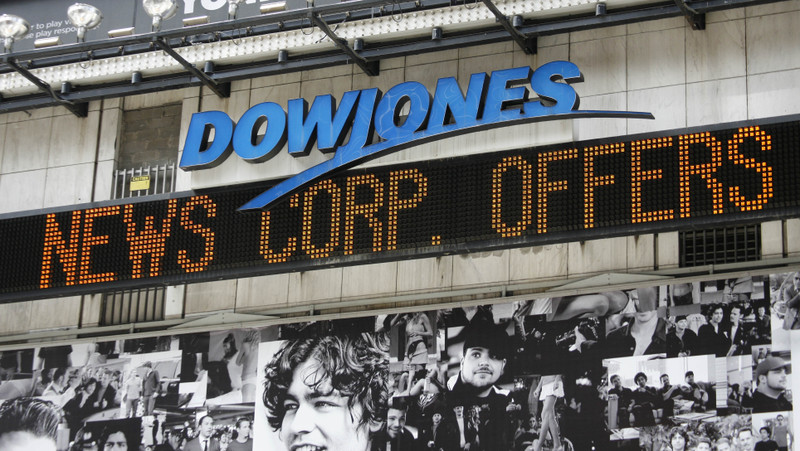

10 May Dow Wow!

We are again in record territory as the Dow Jones Industrial Average remains above 15,000. An amazing achievement considering back in March 2009 we were around 6,000 and as recently as last June down around 12,000. Guess those were the times to be buying!

We are again in record territory as the Dow Jones Industrial Average remains above 15,000. An amazing achievement considering back in March 2009 we were around 6,000 and as recently as last June down around 12,000. Guess those were the times to be buying!

There are several things we know about the stock market. First, after it goes up, it always goes down. Then up again. And so on. This cycle will never and has never been broken. Second, no one can predict with certainty exactly when the ups and downs will occur. Many very smart people have tried and done well, but no one can always get it right. Third, buying individuals stocks has its unique risks, and individual stocks do not always follow the market, and that includes the 30 stocks already in the Dow Jones. Fourth, when an industry or geographic bubble builds, and someone says, “This could last forever,” that’s the time to get out.

The other thing we know: when the market is going up, it is easier, in general, for companies to raise money for growth. So we are very busy these days working with companies that are successfully obtaining capital. This is good. However, it is still very difficult for smaller public companies to raise money, because most investors these days are seeking immediate liquidity when they invest in a public company. But most public companies under $75 million in market value are unable to issue immediate tradable shares easily. Yes some are raising money but it is still challenging. It is also still tough for early stage companies to get that key venture round. Venture firms are more picky than ever, and there are fewer of them around than there were. And many “venture” firms really limit their investments to more established companies with revenues and established operations.

But to horribly paraphrase W.C. Fields’ proposed gravestone quote (it actually never got there), all in all I’d rather see a strong and rising stock market than the alternative.

No Comments